Hydrogen Production Shifts to State Capitols as USHA Ditches Washington

February 13, 2026You might assume that Washington, D.C. is the mecca for the hydrogen lobby. But earlier this year, the United States Hydrogen Alliance quietly told federal agencies: “We’re done pleading our case.” Instead, they’ve set their sights on governors, state energy offices and public utility commissions from coast to coast. This half-defensive, half-opportunistic pivot boils down to one simple mantra: “If D.C. won’t build it, the states will.” It’s an industry message of lost faith in federal lifelines, and a bet that state mechanisms will drive hydrogen production, supercharge hydrogen infrastructure and help hit those ambitious industrial decarbonization targets.

Core News

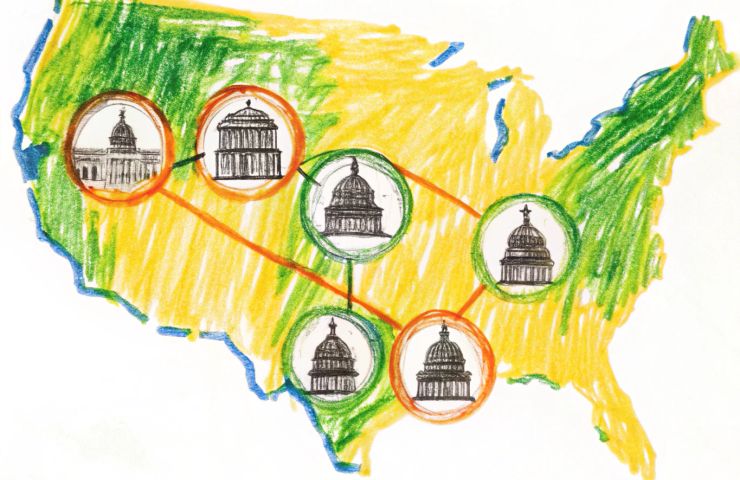

When word started bouncing around that the coveted Section 45V clean hydrogen production tax credit could get trimmed—or vanish once eligibility lapses in 2025—the USHA hit pause on D.C. and booked its tickets to state capitals. Now they’re hammering on legislators’ doors, urging them to pass utility regulations, procurement mandates, fresh tax credits and streamlined permitting for all seven DOE-backed hydrogen hubs spanning twenty states.

Last year, industry reports clocked roughly $41 million funneled into federal hydrogen lobbying. Now, USHA says it plans to steer a hefty chunk of that budget straight into state-level campaigns—from utility rulemakings to procurement task forces—so each state can carve out its own hydrogen playbook.

What It Means: Federal policy has turned into a political pinball game. By anchoring advocacy at the state level, hydrogen developers hope to lock in incentives so sticky that no election cycle can peel them away.

Why Washington Lost Its Shine

Under President Biden, the DOE doled out around $7 billion across seven regional hydrogen hubs under the Bipartisan Infrastructure Law and the Inflation Reduction Act. Texas snagged $1.2 billion, the Midwest pocketed $1 billion, and other hubs stretch from Appalachia’s fossil fields to California’s solar and wind farms. Those hubs were pitched as the backbone for energy security, community resilience and a beefed-up supply chain.

Fast-forward to today, and Republicans in Congress—and whispers from a looming Trump administration—are eyeing cuts to Section 45V. Industry coalitions warn that clipping this credit could derail “tens of billions” in private investment and hand the strategic lead to China, which already dominates global hydrogen tech. That shake-up has left companies hunting for a Plan B, scrambling to shield projects like electrolysis plants, carbon capture facilities and fuel cell factories from federal U-turns.

State-Level Tools Take Center Stage

States aren’t waiting for federal handouts anymore. In Michigan, lawmakers greenlit a $10 million jobs grant and $6 million in tax breaks to lure a $400 million hydrogen gigafactory—advertised with average wages of about $70,000 (we’ll see what the actual payroll looks like). Nevada is doubling down on green hydrogen with strict additionality rules that tie production to new renewable capacity, while Hawaii is pushing fleet decarbonization with hydrogen fuel cells on public buses and ferries. Meanwhile, public utility commissions in Utah and California are sketching out rate designs that could pass the cost of electrolyzer networks straight to industrial power users, and permit offices are piloting single-window approvals to speed things up.

Even die-hard oil-and-gas interests are joining the fray. The American Petroleum Institute and players like Chevron are backing technology-neutral policies that blend blue hydrogen with carbon capture into state incentive packages. At the heart of it all, USHA’s Common Bond campaign is getting a state-focused makeover, marketing hydrogen as a hometown energy win. Utilities, economic development agencies and environmental groups are drafting local offtake contracts to tether green and blue hydrogen projects to steel mills, refineries and trucking fleets—aiming to build a self-sustaining hydrogen economy that can survive even if federal support wavers.

Collateral Ripples

This state-first surge is sending waves across economics, environment, labor and geopolitics:

- Economic Race: States are dangling millions in grants, layered tax breaks and credit stacking. The flip side? Developers might shop for the fattest sweetener instead of the smartest project, risking a fragmented market that erodes economies of scale.

- Environmental Tension: Some states demand lifecycle carbon accounting and strict additionality for electrolyzers, while others hand out subsidies for blue hydrogen with looser CO₂ capture rules. Critics warn this patchwork could end up greenwashing dirtier fuels and extending fossil infrastructure.

- Labor Stakes: In coal and oil transition regions, unions see hydrogen as a retraining lifeline. They’re lobbying to stretch 45V through 2029 to lock in “long-term employment in construction, operations and manufacturing.” Yet those projected $70,000 average wages in places like Michigan are still just promises until the factories fire up.

- Ratepayer Watch: Public utility commissions face a tough balancing act. Passing electrification and pipeline costs to ratepayers could squeeze disadvantaged communities, while deep-pocketed industrial users reap the benefits.

- Geopolitics: China still commands about 60% of global hydrogen technology output. State policy agility is being sold as America’s best defense. And blue hydrogen exports—in 2023 alone, the API tallied $2.15 billion to allies like Japan—underscore the stakes.

- Fossil Fuel Interests: Chevron and legacy energy giants are treating feedstock-based blue hydrogen hubs as a lifeline. Their backing stokes criticism that subsidies might end up props for carbon-heavy infrastructure under a green gloss.

The Maverick Take

Credit where it’s due: USHA has pivoted faster than you can say “incentive cliff.” But ditching federal guardrails for a fifty-state policy chessboard risks boiling down into the same gridlock that’s tripped up U.S. renewable energy. Hundreds of credits, mandates and permit rules can turn into a regulatory spaghetti bowl, leaving developers juggling half a dozen definitions of what counts as “clean.”

Looking Ahead

Next on the schedule is USHA’s invitation-only Hydrogen Policy Leaders Roundtable, where they’ll workshop model legislation. Then come three big 2026 events—from an American Hydrogen Forum in Houston to a Regional Policy Convention in Detroit and a National Policy Summit in Atlantic City—aimed at recruiting more than 179 state policymakers. The goal? Craft ready-to-roll templates for procurement mandates, rate designs and siting rules that can pass with bipartisan support. They’ll also showcase the revamped Common Bond public education campaign, pitching hydrogen as a hometown jobs champion and shield against energy disruptions.

But let’s be real: drafting white papers and running public campaigns doesn’t guarantee shovels hit the ground. States still need to nail interconnection procedures, enforce lifecycle emissions standards, secure rights-of-way and sync up with whatever federal grants remain. Without a safety net, stalled projects risk drying up if pot-of-gold budgets shift with the political winds.

At the end of the day, hydrogen’s ascent now hinges on whether local wins can knit together a sturdy national backbone—or fizzle out as fifty siloed pilots. Buckle up—it’s going to be a wild ride, and the fifty-state policy marathon is officially underway.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.