India Green hydrogen: Overseas project lessons to accelerate India’s domestic rollout

February 4, 2026Ever wondered how setting up a hydrogen plant halfway across the world could actually kick projects into high gear back home? That’s the hot topic everyone’s buzzing about at India Energy Week 2026. The idea is simple: India can lean on its offshore green hydrogen expertise to turbocharge domestic hydrogen production and sustainable energy ambitions.

A national mission on the move

Back in early 2023, the government pulled the trigger on the National Green Hydrogen Mission, carving out INR 19,744 crore to build up everything from production and infrastructure to export muscle. The big goal? Crank out 5 million tonnes of green hydrogen annually by 2030, riding on India’s cheap renewables and a budding electrolyser manufacturing sector. Now, in 2026, the talk has shifted from broad policy promises to real, on-the-ground action.

Voices from the field

Abhay Bakre, the Mission Director steering the National Green Hydrogen Mission, says the industry is on a “launchpad” through 2027—moving swiftly from policy papers to dirt under the fingernails. He’s watching price discovery in new projects and the steady slide in renewable power costs as key catalysts.

R K Malhotra, President of the Hydrogen Association of India, points to two big enablers: a fiercely competitive renewables market and a homegrown supply chain for alkaline electrolyzers. As local manufacturing ramps up, Malhotra reckons green hydrogen hubs will pop up faster than ever.

Han Feenstra, Senior Policy Advisor at the Netherlands’ Ministry of Economic Affairs and Climate Policy, flags Europe’s tightening demand mandates and import rules. He sees a sweet spot for India to carve out a cost-competitive export niche in global hydrogen production.

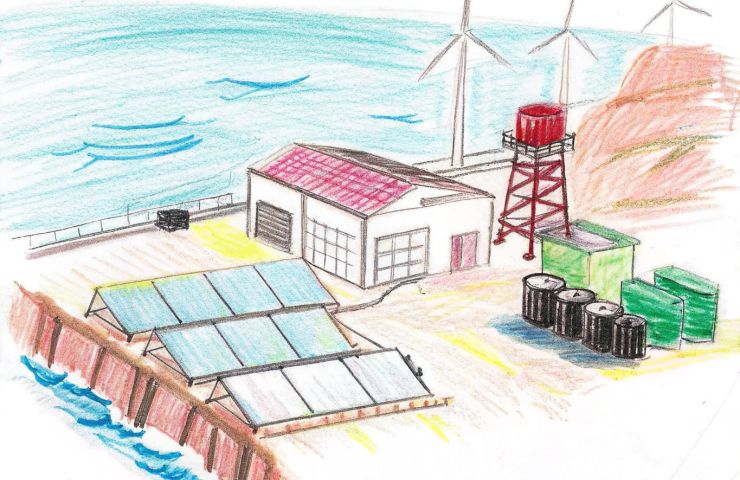

Spotlight on a coastal hub

Take AM Green in Kakinada, Andhra Pradesh, as a prime example. They’re piecing together a 1.95 GW green hydrogen hub, fueled by about 7.5 GW of solar and wind, plus 2 GW of pumped-storage backup. The plan: run electrolysis to split water, then turn that hydrogen into green ammonia through ammonia production processes for export. Just this month, AM Green struck a deal to ship half a million tonnes of green ammonia a year to Uniper.

Technical trenches: refining electrolysis

Under the hood, an alkaline electrolyzer uses a potassium hydroxide solution to shuttle ions between electrodes. Renewable electricity drives the water-splitting reaction, yielding hydrogen and oxygen. By studying overseas installations—tweaking module layouts, cell-stack designs and balance-of-plant setups—developers can dial in optimal equipment sizing, water purification and cooling strategies for India’s diverse climates.

Business models and financing

Funding green hydrogen plants often means mixing long-term offtake agreements, merchant sales and government incentives. In some foreign ventures, they’ve paired feed-in tariffs for power with fixed hydrogen pricing in hybrid structures. Back home, these blueprints could help fledgling developers nail down bankable contracts and hedge revenue risks in still-emerging sustainable energy markets.

Elements to standardize

A consistent lesson from international projects is the power of standardization—whether it’s technical specs for electrolysers or streamlined permit workflows. A common playbook can slash tender timelines, ease vendor checks and cut legal fees. If India locks in shared standards, it could pave a smoother road for both local and foreign investors.

Why overseas experience matters

Projects abroad often grapple with tougher regulations, more complex financing deals and intricate cross-border trade rules. Navigating those challenges teaches developers what really works—be it crafting long-term offtake deals or positioning electrolysers to balance intermittent renewables. Bringing these lessons back home can shave months, sometimes years, off project timelines.

On top of that, price benchmarks set overseas give domestic players solid grounds to negotiate better equipment and capital deals. When global partners see a proven track record, they’re more likely to sign up for long-term green hydrogen or ammonia production agreements with Indian facilities.

Broader impacts and challenges

It’s not all about exports. Analysts suggest that by 2030, green hydrogen costs could dip to around €1.37 per kilogram, spawning up to 600,000 jobs and attracting roughly ₹8 lakh crore in investments. We’re talking major wins—from supplying hard-to-abate sectors like steel and fertiliser to boosting rural livelihoods through biomass and water-sector pilots.

Of course, hurdles remain. Grey hydrogen still undercuts green in many places, and the necessary infrastructure—from pipelines to port terminals—has some catching up to do. Plus, the domestic capacity for electrolyser manufacturing needs to scale up fast to meet rising demand.

Policy in support

The government hasn’t left the sector to fend for itself. Production-linked incentives, viability gap funding and a confirmed ₹600 crore in the latest budget all back the mission’s targets. Later this year, the India Green Hydrogen Assembly will bring together developers, financiers and policymakers to hammer out solutions and forge partnerships.

Global ripple effects

An India that emerges as a green hydrogen powerhouse could shake up global energy trade. European industries racing to decarbonize steel, chemicals and shipping could tap Indian supply as a lower-carbon, cost-effective alternative to coal-based imports. Other emerging markets might follow suit—building their own export hubs or striking bilateral deals—fueling a broader green hydrogen ecosystem.

We’re really at an inflection point—where hard-earned lessons from abroad meet fresh opportunity at home. If India can systematically channel those insights into domestic projects, it could leapfrog several development stages. Picture a pipeline of ready-to-go sites, standardized approvals and electrolyser factories humming away in multiple states.

So, will India seize this moment and cement its place as a true green hydrogen hub? The next few years will be telling.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.