Morocco’s ‘Morocco Offer’ Stakes Global Leadership

October 13, 2025A Race for Clean Molecules

Picture this: a North African country soaking up sunshine and coastal breezes and turning them into energy that decarbonizes heavy industry in Europe. That’s Morocco in a nutshell. With nearly 38 million people, over 2,800 kWh/m² of solar irradiation each year and Atlantic winds blowing at a steady 7 m/s, the Kingdom is primed to become a major green hydrogen hub. A June 2025 IRENA report even flagged its strategic ports—just a hop away from EU markets—for large-scale hydrogen production. Juggling a GDP per capita of roughly $3,550, firmer COP28 climate targets and a National Energy Strategy shooting for 52% renewables by 2030, Morocco sees clean hydrogen as its ticket to economic diversification, energy security and eventually, carbon neutrality.

Unpacking the ‘Morocco Offer’

Back in March 2024, Prime Minister Aziz Akhannouch rolled out what’s now known as the ‘Morocco Offer’—an all-in-one digital portal dubbed the Morocco Green Hydrogen Platform. It opens the door to up to 1 million hectares of public land (300,000 ha up front) for pre-approved green hydrogen and PtX ventures. The National Hydrogen Commission—set up in 2019—oversees leases, grid hookups via ONEE, rights to desalinated water, sweetened power purchase deals, GIS data and perks like green certificates and VAT breaks. In a two-step approach, pilots kick off from 2025 through 2030, followed by export-scale clusters. By mid-2025, nearly 100 investors—from European majors to Middle Eastern sovereign funds and Asian trading houses—have jumped on board, lured by clear rules, competitive tariffs and real-time tracking tools.

Electrolysis and PtX Pathways

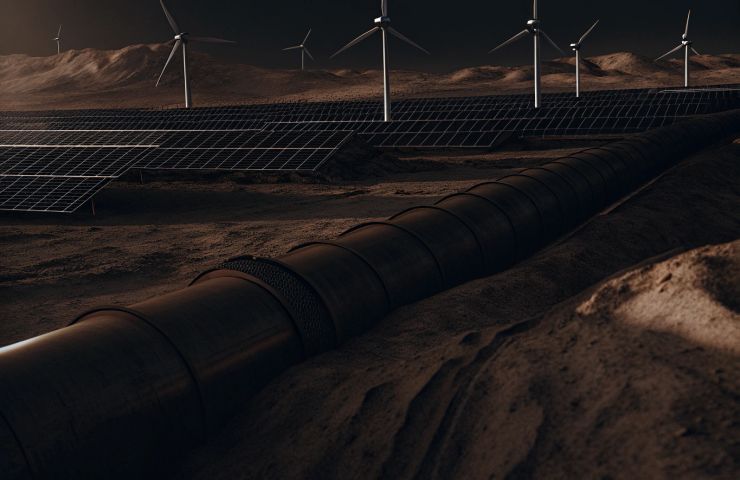

At the core of Morocco’s plan lies massive electrolysis: splitting water into hydrogen and oxygen powered by dedicated solar farms and wind parks. Both alkaline and PEM electrolyzers are in the pipeline, with demo units already humming at the Noor Ouarzazate solar complex and the Tarfaya wind site. They rely on 300,000 m³ of desalinated water per day, and pilot schemes are even recovering salt from brine, thanks to IRESEN. That green hydrogen can be bottled on-site, sent through the proposed H2Med hydrogen corridor or transformed into ammonia, methanol and sustainable aviation fuels via PtX processes. It’s a neat way to balance renewables on the grid while feeding Mediterranean shipping and European industrial zones.

Strategic Partnerships Drive Progress

Morocco’s location and policy playbook have forged tight bonds with Europe—especially Germany. Under the Energy Partnership Morocco-Germany initiative launched in 2023, both sides committed to co-fund pilot projects with KfW, EIB and EBRD guarantees totaling over €1 billion. On the table: technology transfers to build electrolyzers locally and smooth integration into the EU’s REPowerEU strategy. Domestic heavyweights—ONEE, MASEN, OCP, ENSMR and CGEM—are teaming up with German and EU players to beef up local supply chains, aiming for 30% local content. This synergy is seeding decarbonization in steel, chemicals and aviation, while launching training hubs and manufacturing centers from Rabat to Laâyoune.

Navigating Western Sahara’s Legal Frontier

Not all of the land in the ‘Morocco Offer’ is free of controversy. A chunk sits in Western Sahara, a UN-listed non-self-governing territory under Morocco’s administration. UN legal opinions insist on getting local communities’ consent and sharing the benefits—messages echoed by rights groups. Morocco has inked MOUs with Sahrawi committees, pledging 5–10% profit-sharing and formal consultation frameworks. Still, murky land titles and governance models could spark legal fights under various bilateral investment treaties. Some backers are insisting on arbitration safeguards, while others are waiting for clearer tenure rules before sealing the deal.

Economic Multipliers and Industrial Renewal

There’s more to the story than just energy. Moroccan planners foresee over 15,000 direct and indirect jobs by 2030—spanning development, construction, operations and support services. They expect export revenues of $1–2 billion, effectively replacing similar imports in ammonia and fossil fuels. Some strategy papers even dream of Morocco capturing 4% of global hydrogen demand by 2030, though that’s still an optimistic projection. New industrial zones in Laâyoune and Jorf Lasfar are set to host electrolyzer assembly lines, catalyst manufacturing, PtX synthesis hubs and R&D labs. With backing from ENSMR, local universities, CGEM and MASEN, training programs—covering everything from electro-chemical engineering to digital plant management—are already gearing up.

Phasing into a Zero-Emission Future

Morocco’s hydrogen roadmap is split into three acts. The first (2020–2030) focuses on testing rules and launching pilots, targeting 500–1,000 MW of electrolyzers by 2030. That means beefing up the grid and linking up with Spain via cross-border interconnectors, handled by ONEE. Act two (2030–2040) is about driving down costs—aiming for capital expenses under $600/kW and production costs below $2/kg, with help from EIB and EBRD financing. By 2040–2050, mass exports and full sector integration should be in full swing. Casablanca, Agadir and Tangier could be moving millions of tons of hydrogen derivatives each year, cementing Morocco as a key node in the global hydrogen infrastructure network and propelling a zero-emission economy.

Morocco’s laid out the blueprint, but the real test is execution—aligning cutting-edge tech, smart policies, solid financing and community buy-in to turn desert sun and wind into molecules that decarbonize the globe. Will the ‘Morocco Offer’ spark a true green hydrogen revolution, or will legal tangles, logistical kinks and stiff competition trip it up? The next 12 months will tell if policies can flow into pipelines and contracts can turn into construction—a show the whole world is watching.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.