Clean Ammonia Startup Ammobia Raises $7.5M to Scale Modular Haber-Bosch 2.0

January 15, 2026Chances are, when you hear “ammonia,” you picture massive steel reactors belching away in old-school petrochemical plants. Now imagine shrinking all that gear down, dialing back the pressure to a tenth of the usual, and still cranking out ammonia without breaking the bank. That’s the bold idea from Ammobia Inc., a San Francisco outfit that just snagged a fresh $7.5 million in seed funding (on top of the $4.2 million they pulled in last year). They’re championing clean ammonia with their revamped Haber-Bosch 2.0 setup. By chopping operating pressures to about 20 bar and cooling reaction temps by roughly 150 °C, they’re betting they can slash energy consumption in half and trim operating bills by up to 40%, according to a deep-dive by Genesis (Technip Energies).

A Century-Old Process Gets a Makeover

Back in the early 1900s, Fritz Haber and Carl Bosch introduced the world to high-pressure ammonia production: a 200 bar, 500 °C iron-catalyzed loop that gobbles up 1–2 % of global electricity and pumps out around 540 million tons of CO₂ every year. Over the decades, folks have toyed with ruthenium catalysts, fancy membrane reactors, and smarter heat integration, but the basic cycle stuck around. Alternative methods like electrocatalysis and plasma routes grabbed headlines, yet scaling them remained a challenge. Now, Ammobia is rewriting the rulebook—using sorbent-assisted ammonia capture and exploring new non-iron catalysts to push the classic N₂ + 3 H₂ → 2 NH₃ chemistry to milder conditions.

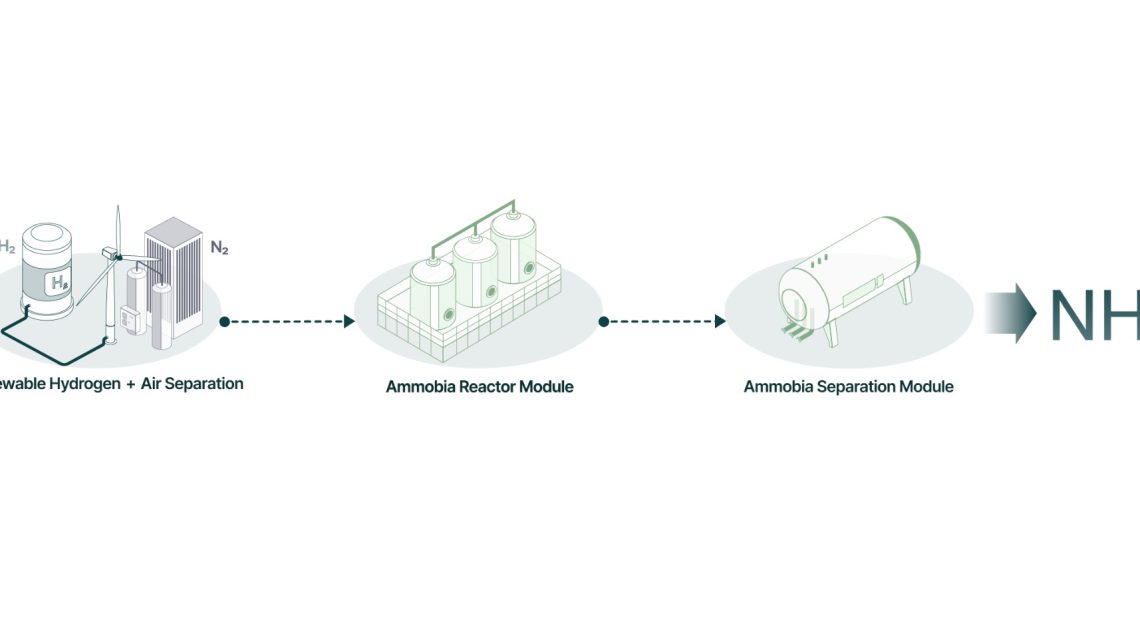

Under the Hood: Modular Chemistry

The heart of Haber-Bosch 2.0 still pulls off that same N₂ + 3 H₂ → 2 NH₃ reaction, but at kinder conditions. A special sorbent snag grabs ammonia as soon as it forms, yanking product out of the mix and nudging the equilibrium toward more synthesis. That trick boosts the per-pass conversion to around 80 %, compared to the usual 20–30 % you see in conventional plants. Running at roughly 20 bar and about 350 °C instead of 200 bar and 500 °C also shrinks the whole footprint. Think little 250 ton/day units you can slap next to renewable-powered electrolyzers or waste-heat sources—no need for gigantic hydrogen pipelines.

Strategic Backing & Validation

Sure, there are plenty of hydrogen and ammonia tech hypes out there, but when the likes of Chevron Technology Ventures, Shell Ventures, and Air Liquide’s ALIAD cut checks, you sit up and pay attention. Alongside investors like Chiyoda Corporation and MOL Switch, Ammobia netted $7.5 million in fresh funding. Add support from the US Department of Energy and a joint study with Genesis (Technip Energies), and they’ve got independent eyeballs on those headline metrics: tenfold lower pressure, 150 °C cooler operations, and up to 40 % opex savings—at least on paper.

Collaborations & Ecosystem

Ammobia isn’t flying solo. They’ve pulled together a network to speed up commercialization and smooth out the bumps:

- Genesis (Technip Energies): Running process simulations and cost analyses.

- Third Derivative: Lending mentorship, funding connections, and technical reviews.

- Universities & national labs: Teaming up on long-term catalyst R&D and scale-up trials.

This collaborative setup not only tackles technical risks but also sets the stage for licensing out complete engineering packages, pushing modular ammonia production into new territories.

Why It Matters

If ammonia production or green hydrogen trends are on your radar, here’s the lowdown:

- Today’s ammonia plants gulp about 2 % of global energy while belching over half a billion tons of CO₂ each year.

- Most plants are colossal (1,000–3,000 ton/day) and built to run flat-out, which doesn’t jive with the ups and downs of renewables.

- Ammobia’s 250 ton/day units can flex with solar and wind—ramping up or down to match power availability.

- Genesis’s analysis suggests potential wins like up to 40 % lower operating expenses, 50 % less upfront CapEx, and safer, milder operating conditions.

That’s huge because ammonia is the backbone of fertilizers feeding half the world and a promising clean ammonia fuel for shipping and power plants—key pieces in the puzzle of industrial decarbonization.

Market & Industry Impact

The global ammonia market is an $80+ billion beast, yet the slice of green ammonia production remains tiny, hamstrung by steep electrolyzer and reactor costs. A lower-pressure, modular route could unlock remote markets, fuel zero-emission shipping bunkers, and power off-grid fuel cells. Analysts reckon green ammonia demand could hit 100 million tons per year by 2030 if costs dip below $400/ton. If Ammobia’s cost-cutting claims hold true, they’ll be well within that sweet spot.

Scaling Challenges & the Road Ahead

Turning lab magic into real-world plants is the next big hurdle. After a successful 250× lab prototype, Ammobia’s eyeing a 1,000× scale demo within the next year. Key knots to untangle include:

- Keeping catalysts stable over the long haul and regenerating sorbents efficiently.

- Syncing with variable renewable hydrogen streams.

- Navigating global permits and licensing for modular chemical setups.

- Building a solid supply chain for specialty materials and pressure vessels.

The real test will be pilot plant performance and early off-take deals—proof that Genesis’s projections can survive in the wild.

Looking Forward

Can Haber-Bosch 2.0 ignite a shift to distributed, low-carbon ammonia production? Backers sure hope so. With support from Chevron, Shell, and Air Liquide, along with DOE grants and incentives under frameworks like the US Inflation Reduction Act, Ammobia’s set to chase its first commercial pilots soon. But at the end of the day, it all boils down to reliable catalyst cycles, hitting cost targets, and smooth integration with green hydrogen. If it all clicks, we might just witness a genuine process revolution—reshaping fertilizers, clean ammonia fuels, and the broader industrial decarbonization landscape.

Either way, the next 12 months are crunch time. If these modular reactors deliver on their promises, they could rewrite the playbook on how we produce one of our planet’s most essential chemicals.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.