Green Hydrogen Corridor: Nordic-Baltic Pipeline Opens Market Call

January 23, 2026Thought Europe’s hydrogen game was settled? Not by a long shot. Six transmission system operators just threw us a curveball with a brand-new Call for Interest to map out a 2,500 km Nordic-Baltic Hydrogen Corridor. Open until the end of March, this isn’t a box-ticking exercise—it’s a genuine invite to hydrogen producers, consumers, hydrogen storage operators, distribution system operators and shippers to spill the beans on forecast volumes, hook-up spots, storage needs and tariff hopes. It’s the first clear market signal for a plan that could totally reshape how we move green hydrogen across Northern Europe.

Quick Facts

Pipeline length: 2,500 km onshore

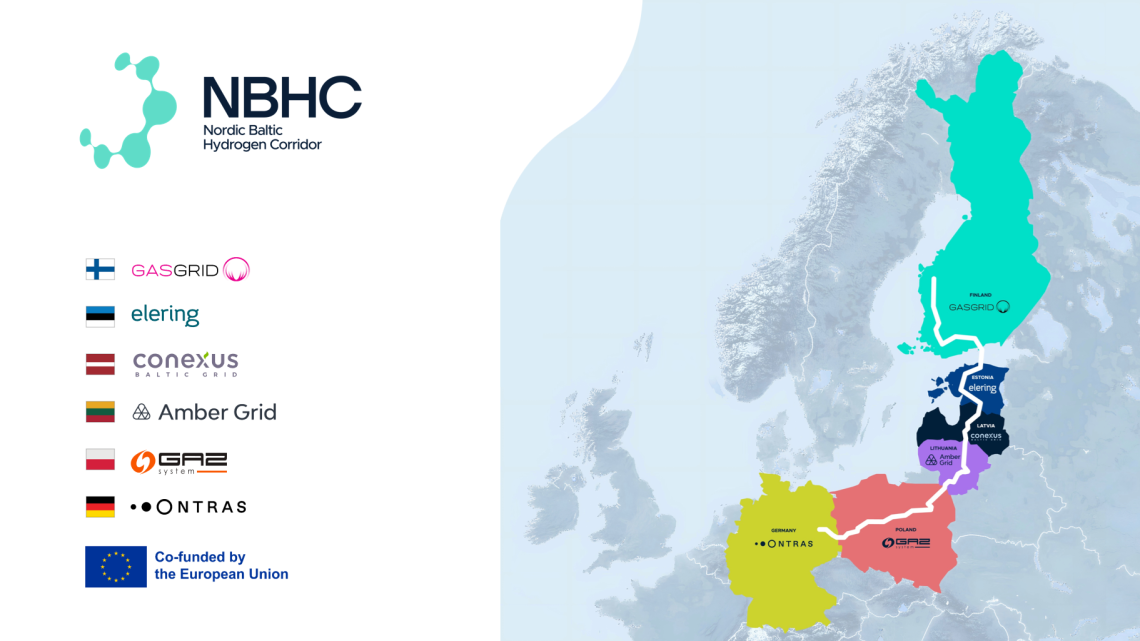

Promoters: Gasgrid Finland, Elering, Conexus Baltic Grid, Amber Grid, GAZ-SYSTEM, ONTRAS Gastransport GmbH

Pre-feasibility: Wrapped up summer 2024; PCI status under TEN-E fast track

Funding: €6.8 M EU CEF grant for detailed feasibility (to early 2027); plus €51.4 M grabbed by Gasgrid Finland in Jan 2025

Capacity: ~2.7 Mt H₂/year

Emission reduction: Up to 37 Mt CO₂ avoided annually by 2050

Survey deadline: 31 March

PCI application: Filed in 2023

Why It Matters

After the 2022 energy crunch, Europe realized it needed to bulk up its renewable molecule supply—and fast. The NBHC aims to link Southern Finland’s wind-rich hydrogen hubs with Germany’s industrial powerhouses. Here’s why it’s a game-changer:

- Supply security: Diversifies the mix by tapping multiple green hydrogen sources

- EU targets: Bolsters the push for 20 Mt domestic and 10 Mt imported renewable H₂ by 2030

- Industrial decarbonization: Offers heavy industries like steel and chemicals a path away from fossil fuels

- Market formation: Lays the groundwork for a competitive cross-border hydrogen infrastructure market

- Policy synergy: Syncs up perfectly with REPowerEU, Fit for 55 and the Green Deal

It’s one of the first hydrogen Projects of Common Interest under the revamped TEN-E framework, joining 16 other priority schemes. That green light gives the project a fast-track to iron out cross-border kinks and hit the ground running.

Technical Realities

On paper, it’s just a compressed hydrogen pipeline—but real-world engineering and eco hurdles make it anything but simple. The promoters are eyeing routes that snake through Finnish forests, Baltic coastal wetlands, Polish farmlands and Germany’s industrial belts. Key considerations include:

- Compression strategy: Optimizing station spacing, 70–100 bar operating pressures and energy use

- Materials: High-grade steels that fend off hydrogen embrittlement and fatigue

- Integration: Hooking into existing gas networks or running standalone loops

- Environmental safeguards: Biodiversity impact studies across Natura 2000 sites, water crossings and soil remediation plans

- Hydrogen storage: Repurposing old gas caverns or developing new salt cavern sites in Poland and the Baltics

Investors will be laser-focused on tariff structures, third-party access rules and possible blending stages. PCI status helps speed up permitting, but juggling six national regulators—with their own timelines and technical specs—means the devil really is in the details.

Strategic Stakes

This isn’t just another stretch of pipe—it’s a strategic pivot for everyone involved. For Gasgrid Finland, it signals a move from domestic gas shipping to green hydrogen export. Elering and Conexus Baltic Grid get to turn Estonia and Latvia into transit hotspots with fewer permit headaches. Amber Grid and GAZ-SYSTEM cement Poland’s role as both transit corridor and offtake market for Central and Eastern Europe. And ONTRAS Gastransport GmbH nails down the German end, primed to serve the Ruhr, chemical parks and refineries. Land anchor offtake deals now, and you could spark hundreds of millions in investment before electrolyzers even hit gigawatt scale.

On the policy front, this blueprint could shape future EU network codes—from tariff harmonization to cross-border cost allocation—areas that are still up for grabs. It might also feed local fuel cell projects or jump-start sustainable energy communities by supplying more reliable molecules to blending-limited sectors.

Collateral Impacts

Beyond slicing up to 37 Mt of CO₂ a year, the NBHC has plenty of ripple effects:

- Regional growth: Fresh roles in construction, operations and maintenance—especially in rural Baltic and Polish areas

- Supply chain boost: Spurs demand for European electrolysers, compressors and pipeline steel

- Energy independence: Baltic states cut import reliance, strengthening resilience

- Market signal: Draws private capital to chase hydrogen storage, fuel cells and related tech

- Environmental oversight: Multi-year wildlife and hydrology studies to keep ecosystems in check

If all goes to plan, NBHC could ignite whole hydrogen hubs and fuel new clusters of sustainable energy innovation right along its path. It could end up as the backbone of a Pan-European network, connecting up to Southern supply routes and Mediterranean import terminals.

What Could Trip It Up

It’s a bold idea—but the road ahead is littered with potholes. First, electrolyser capacity needs to outpace pipeline availability, or you’ve got a chicken-and-egg situation. Second, wrestling six national regulators—each with its own permitting choreography and technical mandates—is a bureaucratic obstacle course. Third, tariff disputes could flare: will transit fees mimic natural gas or demand a hefty premium? Fourth, local pushback in sensitive habitats can stall segments for years—just look at Nord Stream. Fifth, funding a multi-billion-euro dream on a €6.8 M feasibility grant feels like betting the house on pocket change. And let’s not forget potential supply chain snarls for critical components that could knock timelines off-kilter.

Next Moves

Sitting on the hydrogen sidelines? Time to step up. Fill out that survey by end-March with your volume forecasts, preferred tie-in points, compression synergies and tentative offtake lines. The TSOs will weave your intel into refined routes, technical specs and a draft tariff model. Expect one-on-one chats, webinars and national info days before the final feasibility report drops. The faster demand profiles crystallize, the quicker big investment decisions land—and that brings ground-breaking right into view.

This corridor is more than steel tubes and compressors—it’s Europe’s bet on a sustainable energy future. You can sit back and watch, or roll up your sleeves and help draw the blueprint. Which side are you on?

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.