Hydrogen in Minnesota’s Mesabi Iron Range Sparks Clean Energy Shift

October 30, 2025A Second Chapter for the Iron Range

The Mesabi Iron Range in Minnesota has been America’s go-to for rich iron ore since the late 1800s. Now, though, it’s gearing up for a fresh act—one built not on steel but on something far lighter: hydrogen. Beneath those century-old tailings and rugged ridges, energy pioneers are drilling to see if natural H2 reserves can kick-start a new era of sustainable energy and industrial decarbonization. If it pans out, communities that once watched their mills shut down could find a lifeline in hydrogen production.

Exploring Natural Hydrogen

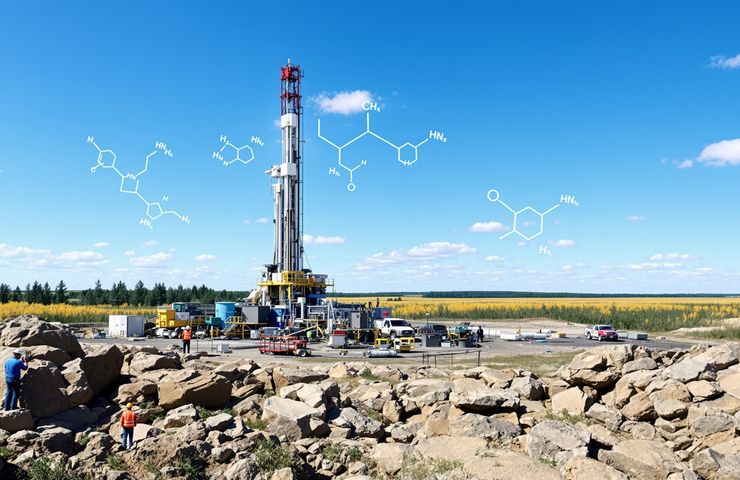

Leading the charge is Québec Innovative Materials Corp. (QIMC) through its arm Orvian Natural Resources, which began exploratory wells in early 2025. They’ve teamed up with Colorado’s Koloma, using seismic surveys to map potential H2 pockets, and Pulsar Helium, bringing deep-gas drilling expertise to hunt for free hydrogen. Everyone’s excited, but until flow rates are on the books, it’s all potential.

Early core samples have shown traces of H2, but true abundance remains a question mark. It’s a high-stakes treasure hunt—if natural hydrogen proves commercial, it could slash some of the costs tied to electrolytic methods and reshape the economics of hydrogen production.

Green Hydrogen and a Decarbonized Steel Sector

Meanwhile, over at the University of Minnesota’s Natural Resources Research Institute (NRRI), teams are pairing wind and solar farms with electrolysis units to churn out green hydrogen. The aim? Fuel pilot-scale steel furnaces that exhale nothing but water vapor instead of CO2. It’s a hands-on demo of how clean hydrogen production can dovetail with one of the nation’s most carbon-intensive industries.

If NRRI’s tests hit their marks, this could be a major leap in industrial decarbonization. Swapping blast-furnace coke for H2 could cut steelmaking emissions dramatically, keeping U.S. producers competitive in a greener global market.

Federal Momentum and Regional Hubs

Washington isn’t letting the concept fade. The U.S. Department of Energy has earmarked billions for Regional Clean Hydrogen Hubs to spark up full-scale hydrogen infrastructure—pipelines, storage terminals, you name it. One of the loudest advocates is Tom Erickson, President and COO of the Heartland Hydrogen Hub, who argues that an integrated H2 network is critical for shaving costs and smoothing supply chains.

Mesabi’s proximity to existing rail lines and power corridors gives it a head start. It’s not just about tapping reserves—it’s about weaving production, transport, and end-use into one seamless system.

Jobs, Growth, and Local Impact

On the ground, exploratory drilling has already put geologists, engineers, and field crews back to work—reversing years of talent drain. If commercial flows are confirmed, we could see hundreds of construction jobs for plants, pipelines, and terminal upgrades.

Local shops are gearing up for new service contracts, and community colleges are exploring certificate programs in fuel cell technology and hydrogen handling. After decades of watching folks leave, Mesabi could start keeping its next generation of workers right at home.

Infrastructure: Piping and Storage

“Getting permits is only the opening act,” jokes a QIMC spokesperson. Building out real hydrogen infrastructure—from high-pressure lines to cryogenic tanks—is a technical and financial marathon. Luckily, Minnesota’s established energy corridors, once used for natural gas or slurry lines, can sometimes be repurposed, speeding up approvals.

Of course, you’ve got to win over landowners, navigate public safety concerns, and hit strict pipeline standards. It’s a tall order, but the payoff—robust H2 networks and lower transport costs—is massive.

Innovation Under the Surface

Drilling’s just one piece of the puzzle. In labs across the state, startups are experimenting with nanostructured catalysts to boost electrolysis efficiency. The less juice you burn per kilo of hydrogen, the faster green hydrogen becomes price-competitive with fossil-derived H2.

Some teams are even floating the idea of solar farms planted directly above wellheads, feeding power straight into on-site production. Over at NRRI, novel membranes that cut precious-metal use aim to make electrolyzers cheaper and tougher.

Challenges in the Deep Subsurface

Tapping natural hydrogen isn’t like pumping water. H2 can hide in microscopic pores or cling to deep minerals, demanding slick geophysical models and advanced drilling techniques. Every new hole is a gamble—costs often top $1 million before you know if it’ll flow.

That’s where Pulsar Helium’s track record in unconventional gas plays pays off. Even so, patience and precision are key when you’re chasing molecules that weigh next to nothing.

Market Dynamics and Competition

Investors are watching Europe’s incentives—sometimes $3 per kilo for green hydrogen—and betting on early movers. But U.S. producers could carve out a niche by serving nearby industrial clusters: Great Lakes steel makers, Gulf Coast refineries, and Midwest ammonia plants shifting to clean feedstocks.

Meanwhile, ambitious solar-to-hydrogen projects in the Middle East threaten to undercut prices. Minnesota’s big asset? Short delivery routes into domestic factories, trimming shipping costs and supply-chain headaches.

Financing the Transition

Capital is king, and federal loan guarantees plus state grants can make projects more bankable. Traditional equity investors often shy away from decade-long payback periods, so government backing is a real game-changer.

Minnesota’s already dangled tax credits for H2 projects, and the DOE’s Hydrogen and Fuel Cell Technical Advisory Committee is mapping out best practices to de-risk investments. When you mix in solid corporate players like Koloma, lenders start to sit up and take notice.

The Road Ahead

The next few months of drill results will be critical. If Mesabi’s wells hit commercial flow rates, expect a stampede of partnerships—energy majors, pipeline operators, steelmakers, and renewable developers all vying for a piece of the action.

At the same time, labs and universities will push to cut electrolyzer costs and scale up hydrogen storage solutions. It’s a complex jigsaw—geology, engineering, finance—but the prize is a brand-new clean-fuel economy.

Embracing a Zero-Emission Future

There’s no guarantee Mesabi will become the next hydrogen powerhouse, but the ingredients are on the table: geological promise, corporate drive, academic smarts, and policy support. If it works, this old iron heartland could flip its Rust Belt story into a showcase for zero-emission technology and sustainable energy production.

It’s a steep climb—technically, economically, and politically—but a successful pivot here could light the way for other industrial regions eager to rewrite their own futures.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.