Hydrogen Production at Aichi Steel’s Chita Plant

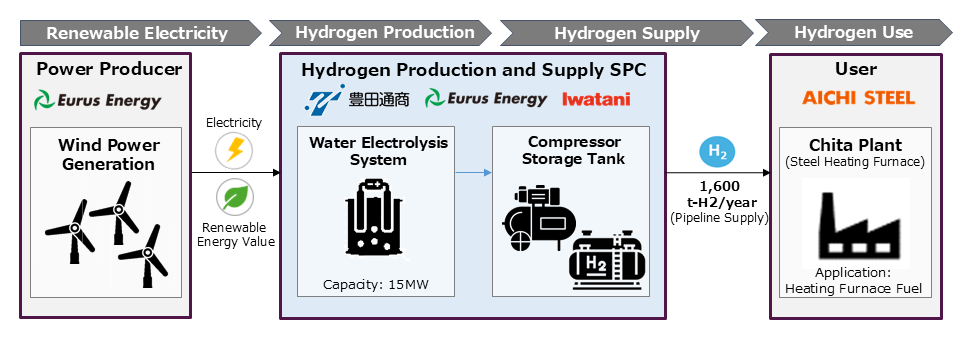

October 1, 2025Picture a steel plant buzzing away, not on natural gas but on green hydrogen made right next door with wind power. That vision stepped off the drawing board on September 30, 2025, when Toyota Tsusho Corporation, Eurus Energy Holdings and Iwatani Corporation unveiled plans to build an on-site, low-carbon hydrogen production and supply system at Aichi Steel’s Chita Plant in Tokai, Aichi Prefecture. Backed by a thumbs-up from METI under the Hydrogen Society Promotion Act, this pilot aims to swap out natural gas in steel-heating furnaces for clean-burning green hydrogen, gearing up for full-scale operations by 2030.

Project Details

At its core sits a water electrolysis system from Chiyoda Corporation, fitted with Toyota Motor stacks. It’ll run on renewable juice from Eurus Energy’s nearby wind farms, splitting water into hydrogen and oxygen right on-site. The big milestones look like this:

- Operations launch: 2030

- Annual output: about 1,600 tons of hydrogen

- Joint venture formation: 2027

- Subsidy scheme: METI’s price-gap support for up to 15 years

By making hydrogen where it’s needed, they dodge transport headaches and safety worries tied to offsite delivery—creating a blueprint any industrial site could copy as part of a broader hydrogen infrastructure.

Why These Partners

Every member brings something crucial to the table:

- Toyota Tsusho: Since 1948, this trading arm of the Toyota Group has branched into energy and carbon-neutral projects, honing its skills in big infrastructure rollouts.

- Eurus Energy: A renewable trailblazer since 1986, Eurus runs wind and solar farms across Japan, supplying the clean power that fuels this hydrogen production scheme.

- Iwatani: Founded in 1930, Iwatani is a go-to for gas and hydrogen know-how—covering production, storage and distribution, and pushing Japan’s hydrogen economy forward.

Economic and Policy Drivers

Decarbonizing steel is no walk in the park—traditional furnaces lean hard on fossil fuels, and big carbon-capture setups are still pricey. By plugging straight into Aichi Steel’s operations, this pilot smooths out two major roadblocks:

- Cost parity: METI’s grants under the Hydrogen Society Promotion Act bridge the gap between hydrogen and natural gas prices, making the numbers add up during these early stages.

- Regulatory certainty: Certification from national and local bodies—like the Chubu Region Hydrogen and Ammonia Social Implementation Promotion Council—speeds up approvals and locks in safety standards.

Put those together, and investors get a clear runway for rolling out more hydrogen infrastructure down the line.

Policy Framework

Japan’s Hydrogen Society Promotion Act, which kicked in October 2024, lays out subsidies and certifications to fast-track commercialization. METI’s price-gap support will cover the cost difference between H₂ and incumbent fuels for up to 15 years, while codified safety rules and network targets stretch to 2030. On the regional front, the Chubu council—set up in February 2022—brings local governments and industry groups together to build pipelines, storage and distribution facilities.

Evolution of Hydrogen in Japan

Japan’s fascination with hydrogen dates back to the 1970s oil shocks, but it really kicked into high gear in the 2010s with fuel-cell vehicle pilots and microgrid demos. Those projects proved the concept, yet heavy industry remained the missing puzzle piece. By partnering with a major steelmaker like Aichi Steel, the consortium is tackling one of the toughest emissions challenges head-on.

Industrial and Regional Context

Tokai City, home to roughly 113,000 people, has long been a steel and manufacturing hub. Shifting the Chita Plant to hydrogen fits right into Aichi Prefecture’s wider energy transition push. Local industry groups and the Chubu council have already sorted out much of the safety, land-use and grid-connection groundwork—so this project feels like the natural next step.

Collateral Impacts

Beyond chopping CO₂ emissions, the pilot will:

- Stimulate regional investment in electrolyzer manufacturing and renewable assets

- Advance know-how on high-pressure hydrogen storage and handling

- Create skilled jobs in operations, maintenance and R&D

- Shape regulatory frameworks for future hydrogen infrastructure

Global Implications

Europe and Australia are racing on similar projects, but Japan’s blend of national policy and regional coalitions could become a go-to model for public-private industrial decarbonization partnerships. If Aichi Steel pulls this off, we could see this playbook exported to industrial powerhouses worldwide.

Risks and Challenges

No pilot’s risk-free. The consortium will be watching:

- Cost uncertainty: Can competitive hydrogen prices stick once subsidies wind down?

- Technical scale-up: How long will electrolyzer stacks last under nonstop industrial loads?

- Grid integration: Balancing variable wind output to keep electrolysis humming.

- Logistics: Safe on-site storage and handling of large hydrogen volumes.

Replication & Scale

The joint venture set for 2027 will nail down investments, governance and tech-transfer deals. Hit the 2030 goal of 1,600 tons per year, and phase two could bulk up electrolyzer capacity or supply neighboring plants. They might even branch into fuel cell technology for backup power or crank out ammonia production—opening up fresh revenue streams.

Looking Forward

If the Chita Plant hits its 1,600-ton annual mark, it could be a watershed moment for industrial decarbonization. By 2030, we might see a wave of steelmakers switching to on-site green hydrogen, a boom in electrolyzer manufacturing and subsidy schemes giving way to market-driven incentives. From an investor’s angle, this project shows the power of pairing public policy with private innovation. Japan’s shouldering early hydrogen demand, but long-term success hinges on driving production costs under ¥30/kg. Nail that, and the Chita Plant blueprint could ripple across Asia and beyond—reshaping how heavy industry sources its heat.

As we inch toward carbon neutrality by 2050, this pilot is the acid test: Can hydrogen truly tackle one of the world’s toughest emission challenges? If the answer’s “yes,” steel—and the planet—are in for a sustainable energy makeover.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.