Hydrogen Production Revolutionised by Metallic Nanofiber Mesh Electrodes

August 25, 2025If you’ve been keeping an eye on the green hydrogen market, M-Spin just gave you a reason to pay extra attention. This UK start-up, spun out of Imperial College London in 2024, just closed a £1.2 million seed round and scored a £25,000 grant from the Henry Royce Institute. Their secret sauce? A novel metallic nanofiber mesh electrode that promises to supercharge electrolyser performance—and could slice production costs by 20–30%.

Born from seven years of tinkering at Imperial’s Energy Futures Lab, the founding crew—four PhD chemists and two electrochemical engineers—has already locked down two patent families covering metal electrospinning recipes and binderless mesh architectures. In short, they’ve built a fortress around their IP as they gear up to scale. And with industry veterans on their advisory board for electrolyser manufacturing and scale-up, they’re hardly flying blind.

Strategic Upside

Early institutional backing isn’t just a gold star; it’s a green light for more investors and strategic partnerships. Even better, M-Spin’s retrofit-friendly design lets operators drop these mats into existing electrolyser stacks—no rip-and-replace required. That kind of simplicity sings to:

- Electrolyser OEMs hunting for a quick product boost without reinventing the wheel.

- Project developers chasing lower capex and faster commissioning.

- Energy retailers keen to lock in bulk green hydrogen supplies and tighten margins.

Europe’s push for 10 million tonnes of renewable hydrogen by 2030 means massive upside for low-cost electrolysers. M-Spin’s already in talks with anchor customers in the UK and Germany, where procurement pipelines are heating up. Their mesh could fast-track profitability for gigawatt-scale facilities by trimming upfront spend and boosting runtime efficiency.

Technical Snapshot

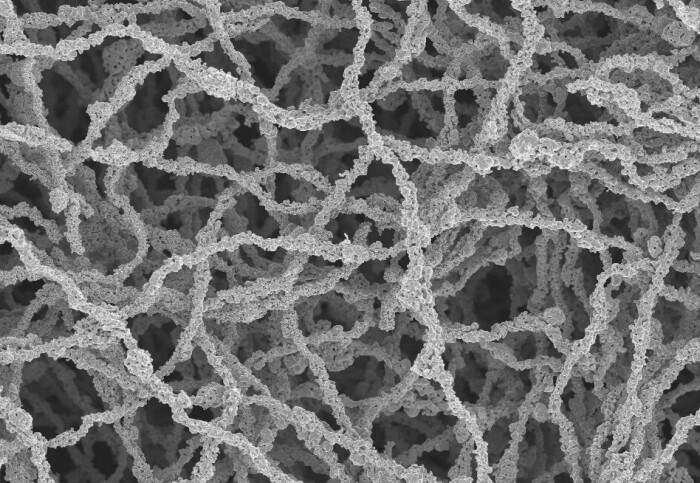

At the core is a fresh spin on electrospinning. Instead of polymer or carbon fibers, M-Spin’s R&D team—shout-out to Professor Nigel Brandon’s lab—has dialed in metal-based recipes. Here’s the nutshell version:

- Fiber diameter: 500 nm to 1 µm, balancing toughness with high surface exposure.

- Porosity: Up to 90%, which smoothed out mass transport of reactants and gas release.

- Surface area: As much as 1,000× that of metallic foams, multiplying active sites for water splitting—the core of hydrogen production.

- Material versatility: Nickel, iron, copper and ceramics—each tuned to specific electrolyser chemistries.

In lab-scale trials (50 cm² electrodes), they’ve hit current densities north of industry benchmarks, running stably at 1 A/cm² for more than 100 hours. Next up: scaling to 1 m² modules, with demo units planned for Q1 2026. And roll-to-roll tests at the Henry Royce Institute show the concept can stretch to industrial volumes.

Historical Momentum

For too long, electrode tech was the choke point in electrolysis. Early alkaline and PEM systems leaned on clunky metal foams with limited active area. Nanostructured fixes have popped up in journals over the past decade, but few ever made the leap from lab to factory. M-Spin’s mesh fuses nanoscale engineering with manufacturing pragmatism—just as Europe’s Hydrogen Strategy and the UK’s Ten Point Plan unlock over £1 billion for sustainable energy and industrial decarbonization projects.

Competitive Landscape

It’s a crowded arena: legacy electrolyser makers still rely on sintered foams and mesh from big suppliers like Linde, while a handful of start-ups in Germany and the US chase nano-coated or laser-etched electrodes. M-Spin’s edge? A native nanofiber network that skips costly coatings and extra post-processing steps. In plain English, that means a lower cost per square meter of electrode—critical when you’re rolling out multi-gigawatt installations.

Market Outlook

Global electrolysis capacity is poised to leap from under 2 GW today to over 100 GW by 2030, driven by net-zero pledges and booming renewables. Annual hydrogen market revenues could top $300 billion by mid-decade. In that landscape, a 20–30% capex cut in electrolysers translates into tens of billions saved. For early movers like M-Spin, that’s a shot at serious market share—provided the performance and durability live up to expectations.

Technical Hurdles

The real test lies in long-haul durability: corrosion resistance, mechanical fatigue under cyclical loads, and survival in harsh alkaline or acidic environments. M-Spin’s 100-hour runs are a promising start, but 10,000-hour data will make or break their levelized cost-of-hydrogen models. And building roll-to-roll modules means nailing thermal management and seal integrity to prevent membrane damage and gas crossover.

Collateral Impacts

If this nanomesh delivers, the ripple effects could reshape multiple sectors:

- Heavy industry: Green hydrogen at $1.50–2.00/kg could finally decarbonize steel, refining and ammonia.

- Ammonia production: Lower energy inputs might cut fertilizer costs—a boon for global food security.

- Mobility: Fuel cell fleets become more cost-effective as fuel expenses drop.

- Energy storage: More efficient electrolyser-capacitor hybrids smooth out renewable intermittency.

- Supply chains: Demand for nickel, copper and ceramics spikes, fueling upstream investment.

- Fuel cell tech: These mesh designs could boost electrode performance in fuel cell mode too.

Beyond just cutting costs, these shifts fuel broader sustainable energy adoption and underscore hydrogen’s role in industrial decarbonization.

Main Insights

- Prototypes show up to 5× higher hydrogen output and 20–30% cost reduction, according to M-Spin—results that look great but still need independent verification.

- Roll-to-roll processing combined with retrofit compatibility slashes deployment times compared to greenfield redesigns.

- Backing from Imperial’s spin-out ecosystem and the Henry Royce Institute accelerates iteration cycles and rigorous testing.

Next Steps

M-Spin is gearing up pilot-scale trials at Imperial’s hydrogen labs to prove multi-thousand-hour durability. They’re negotiating licensing deals with OEMs across Europe and Asia to fast-track market entry, and exploring dual-use mesh designs that work in both electrolysis and fuel cell modes—streamlining supply chains for end users.

Expert Viewpoint

From where I’m sitting, M-Spin nails a critical balance: a high-performance nanostructure that’s genuinely scalable. The long-duration data will be the ultimate decider, but if they hit their cost and durability targets, expect faster project approvals, bolder offtake deals and a reconfigured investment picture for sustainable energy infrastructure. Whether you’re an investor hunting for the next big thing in electrolysis or an operator chasing a lower TCO, M-Spin’s nanomesh deserves a hard look—it just might be the materials breakthrough that pushes green hydrogen into the mainstream.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.