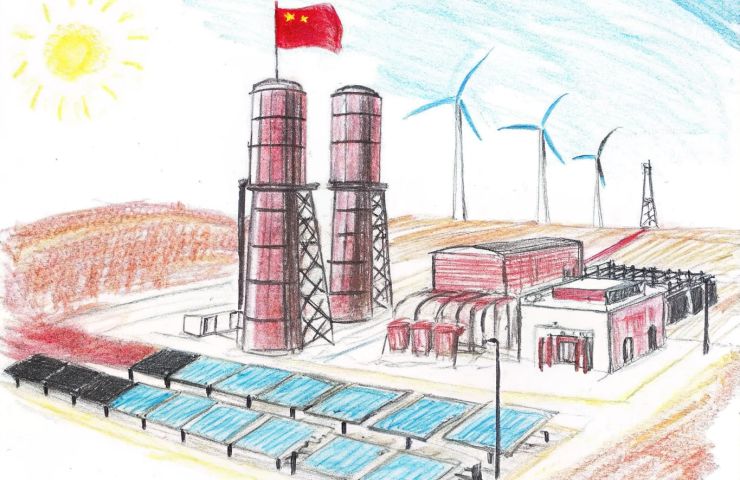

Hydrogen Production Takes Center Stage in China’s 15th Five-Year Plan

November 6, 2025China is putting hydrogen production front and center for its next five-year stretch, aiming to hit industrial-scale breakthroughs between 2026 and 2030. With the Communist Party of China shaping the 15th Five-Year Plan, green hydrogen made via electrolysis isn’t just a buzzword—it’s a strategic catalyst for sustainable energy and industrial decarbonization, and will help kickstart a robust hydrogen infrastructure.

Industrial Ambitions and Policy Drivers

Under the CPC’s watch, the State Council is sketching out a roadmap—destined for National People’s Congress approval around early 2026—that will lay out how China plans to:

- ramp up electrolyzer manufacturing capacity;

- weave hydrogen into heavy hitters like steel and chemicals;

- roll out more hydrogen refueling stations for transport fleets.

All of this ties back to bolstering energy security, dialing down coal dependence, and fueling high-quality growth through innovation.

Why Hydrogen Matters for China’s Energy Security

As the world’s top energy guzzler, China still leans heavily on coal for over half its power. By cranking up the hydrogen dial—a zero-carbon carrier when backed by renewables—Beijing tackles three big challenges at once:

- Decarbonization: Hard-to-abate sectors like refining and steel get a cleaner feedstock in hydrogen.

- Supply resilience: Domestic hydrogen production soothes exposure to volatile global fuel markets.

- Pollution control: A cleaner industrial base means less smog and a smoother ride toward CO₂ targets.

Tech Pathways: Electrolysis and Beyond

China’s game plan zeroes in on two main production tracks:

- Water electrolysis powered by wind and solar—this is the backbone of green hydrogen.

- Natural gas reforming paired with carbon capture—an interim route to low-carbon output.

Pushing down equipment costs and scaling up gigawatt-level electrolyzer factories will be key, even if Beijing hasn’t tweeted exact milestones yet.

Market Implications and Infrastructure

Going big on hydrogen will reshape China’s energy scene:

- Massive bets on hydrogen pipelines and storage hubs, linking coastal production zones to inland industrial clusters.

- Upgrades to the national grid and smarter dispatch systems to juggle renewable swings.

- Bringing hydrogen projects into the emissions trading system to tighten carbon caps.

Sure, electricity rates might edge up in the short term, but tweaks to China’s Energy Law aim to lure private capital and clear red tape—critical for financing sci-fi-scale infrastructure.

Public Consultation and Market Reform

In a rare move, the CPC is opening the doors for expert feedback and public viewpoints as it polishes the Plan. This consultative vibe, along with a tech-neutral stance, is meant to keep policies nimble as breakthroughs emerge. Meanwhile, proposed reforms will give private players room to build and manage hydrogen assets alongside state giants.

Long-Term Outlook

Pinning hydrogen at the heart of its policy playbook could give China a homegrown edge in a field set to redefine global energy. On the horizon:

- Export potential: Surplus green hydrogen or derivatives like clean ammonia could flow to Asia and Europe.

- Cost declines: Local scale and supply chains might drive electrolyzer prices below Western levels.

- Global standards: Beijing’s sway in international alliances could shape certification and trade rules.

All eyes will be on whether these policy ambitions translate into real-world projects and commercial wins. As the final draft takes shape by March 2026, expect a flurry of demos, partnerships, and financing announcements. If China pulls it off, it could not only rewrite its own energy story but also set the pace for hydrogen adoption worldwide.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.