Hydrogen Storage: Provaris Energy and Baker Hughes Team Up for Marine Logistics

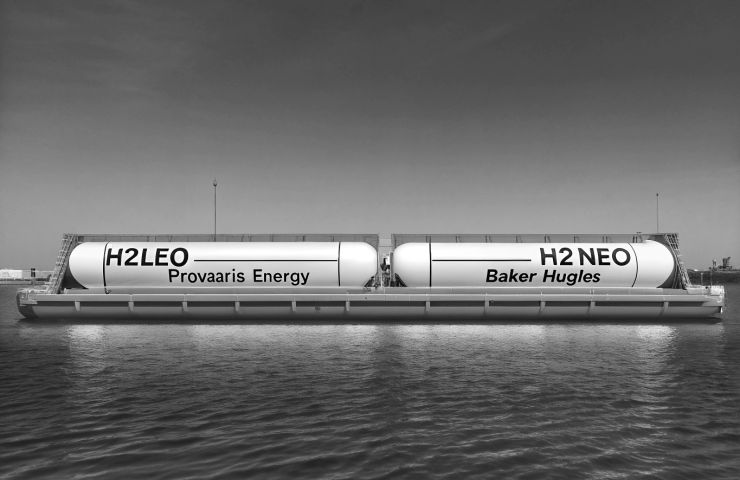

September 5, 2025On 4 September 2025, Provaris Energy and Baker Hughes officially sealed a strategic partnership to shake up how we move hydrogen at sea. By combining Provaris’ slick H2Leo barge and beefy H2Neo carrier designs with Baker Hughes’ top-tier compression gear and plant know-how, they’re aiming to crack one of maritime transport’s biggest headaches: scalable, cost-effective compressed hydrogen shipping and robust hydrogen storage solutions. It’s a bold move that could pave the way for cleaner cargo routes on rivers and oceans alike, boosting marine logistics networks just when ports and carriers are hunting for sustainable energy answers to hit those tough emissions targets.

Strategic Implications

This collaboration rides the wave of investors pouring cash into sustainable energy and hydrogen storage infrastructure within marine logistics. With the International Maritime Organization cranking down on carbon emissions, shippers and ports are scrambling to adopt zero-emission fuels. Marrying Provaris’ lightweight, high-pressure containment tech with Baker Hughes’ proven compressor systems trims out technical risk and speeds up time-to-market. Now both companies can pitch end-to-end offerings—vessels, onshore compression, remote monitoring—to shippers, terminal operators and regulators, staking their claim in an emerging segment that could pull in billions each year.

Technical Integration

Right at the core of their pact are Provaris’ two flagship designs. The H2Leo barge, made for inland and coastal hops, sports modular tanks that keep hydrogen pressurized safely. For blue-water missions, the H2Neo carrier steps up with extra volume, a reinforced hull and smart sensor arrays. Baker Hughes brings industrial-grade compressors that hit over 700 bar with minimal energy loss, plus turnkey plant layouts and cost-modeling tools to sync onshore loading stations with vessel throughput. Together, they’re streamlining the end-to-end supply chain, cutting complexity and boosting reliability.

Industry Context

Hydrogen’s maritime journey has often felt stuck in neutral, thanks to patchy infrastructure and safety jitters. But recent pilots—think Edge Navigation’s river trials and DNV’s 20,000 m³ carrier concept—are shifting the narrative. This deal between Provaris and Baker Hughes, which grew out of an August 2024 MoU, signals a clear move from proof-of-concept to commercial rollout. If regulators, insurers and port authorities can align on common standards and emergency protocols, that snowball could turn into a full-blown hydrogen economy for marine logistics.

Business Model

The plan’s a phased rollout. First up: pilot runs in 2026 on select European and Australasian waterways, backed by a mix of corporate funds and possible grants. Operators subscribe to integrated packages covering vessel leases, onshore compression services and 24/7 monitoring support. Provaris and Baker Hughes will also co-develop an asset-lifecycle management platform, delivering predictive maintenance alerts to minimize downtime. By locking in multi-year contracts, they aim to secure steady revenue streams while demonstrating shipping costs within a 15–20% premium over LNG equivalents.

Market Competition

Provaris and Baker Hughes aren’t the only players angling for a slice of the hydrogen marine pie. Startups and traditional shipyards are busy testing ammonia-to-hydrogen cracking, liquid organic hydrogen carriers and cryogenic tanks. Their edge—compressed hydrogen—avoids the energy penalty of liquefaction and the safety headaches of ammonia. Still, they face rival grant bids and intense scrutiny over compressor efficiency. Winning over customers will hinge on proving rapid loading times, minimal boil-off and rock-solid safety records—metrics that’ll make or break adoption over the next two years.

Key Takeaways

- Combines top-tier carrier design and compression expertise to slash technical barriers.

- Targets regulatory-driven demand for zero-emission fuels under new IMO standards.

- Builds on an August 2024 MoU, moving from concept to pilots in 2026.

- Uses asset leasing and subscription models to secure recurring revenue streams.

- Positions compressed hydrogen against liquefied and ammonia-based alternatives in the marine energy mix.

Risks and Challenges

Don’t get me wrong—there are hurdles. Navigating complex permits, upgrading port infrastructure and sourcing high-grade steel or specialized valves could slow the rollout. Plus, hydrogen feedstock prices can swing wildly depending on regional electrolysis capacity and renewable power costs. Everyone’s also watching how regulators nail down transport standards and emergency response protocols. If the technology or finances stumble, fleet operators might hit the brakes on conversions, stalling wider uptake and cooling investor enthusiasm in what’s still seen as a high-risk segment.

Expert Perspective

“We see this deal as a significant step toward making hydrogen a practical marine fuel,” says Per Roed, CTO of Provaris Energy. “By blending our carrier designs with Baker Hughes’ compression know-how, we’re tackling the toughest technical hurdles head-on. It’s all about reliability, safety and real-world economics.” Industry analysts add that partnerships like this one offer a blueprint for marrying fresh innovation with established manufacturing muscle. The real test? Scaling smoothly without tripping over operational hiccups.

Looking Ahead

Mark your calendars: pilot routes on Europe’s inland waterway network are slated for late 2026, followed by ocean trials in the Asia-Pacific in 2027. Success will be measured by loading windows under two hours, 99.5% containment efficiency over long voyages and total cost of ownership within 20% of LNG benchmarks. Nail those targets, and this model could roll out across key corridors—Northern Europe to the UK, Southeast Asia and the US Gulf Coast—setting fresh standards for hydrogen storage infrastructure and drawing new investment into marine decarbonization.

By marrying Provaris’ cutting-edge vessels with Baker Hughes’ compression prowess, this tie-up could reset expectations for transporting hydrogen at sea. For executives eyeing clean-fuel markets, it’s a clear signal: teaming nimble innovators with seasoned tech leaders might just be the winning formula to drive sustainable energy forward in marine logistics.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.