Hydrogen Utopia and Hydrogen Systems to Deploy Waste-to-Hydrogen Plants in Saudi Arabia

January 7, 2026Hydrogen Utopia International PLC (AIM: HUI) has struck a non-binding Memorandum of Understanding (MoU) with Saudi-based Hydrogen Systems, setting the stage for waste-to-hydrogen conversion plants across the Kingdom. By pairing Hydrogen Utopia’s proprietary pyrolysis and gasification process with Hydrogen Systems’ Shell-branded refuelling network, the collaboration dovetails perfectly with Saudi Arabia’s Vision 2030 push for green hydrogen, sustainable energy and broader industrial decarbonization.

- Who: UK-listed Hydrogen Utopia International PLC and Saudi Arabia’s Hydrogen Systems.

- What: MoU to build waste-to-hydrogen plants that link waste conversion with refuelling infrastructure.

- Where: Kingdom-wide (exact sites still under review).

- When: Signed on 6 January 2026.

- Why: To ramp up hydrogen production, support circular-economy goals and help Saudi hit 4 percent of global hydrogen supply by 2030.

- How: Heat non-recyclable waste in an oxygen-free reactor (pyrolysis) to make syngas, purify it into high-purity hydrogen, then feed it into high-pressure refuelling stations.

Technical Insight

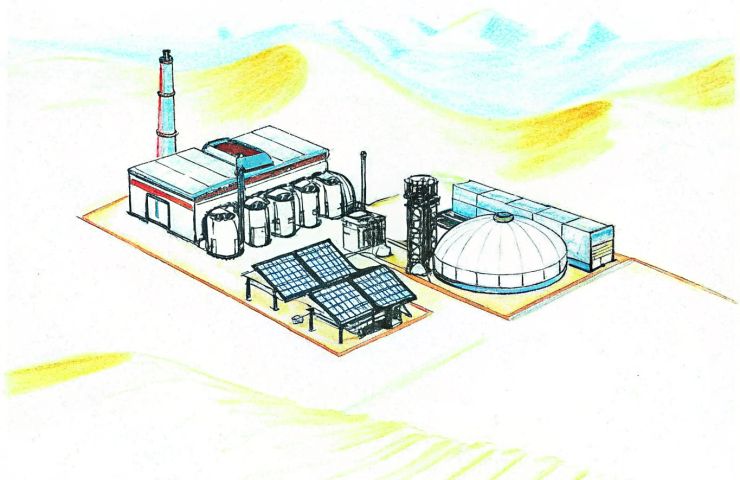

At the heart of this partnership is waste-to-hydrogen conversion. Hydrogen Utopia’s system heats mixed non-recyclable waste in an oxygen-starved reactor—think high-tech cooking—to produce syngas, a cocktail of hydrogen, carbon monoxide and methane. Next, pressure swing adsorption and membrane separation clean that syngas up into ultra-pure hydrogen. The result? Trash that would’ve ended up in landfills or incinerators becomes a feedstock for clean fuel, strengthening the Kingdom’s hydrogen infrastructure.

Market Dynamics and Funding

Riyadh has already earmarked billions to supercharge its hydrogen economy, with export eyes set on Asia and Europe. The global hydrogen market sat at roughly $130 billion in 2023 and is forecast to exceed $650 billion by 2030. By combining Hydrogen Utopia’s waste valorization tech with Hydrogen Systems’ Shell-branded refuelling network, both firms are well-positioned to tap public and private funding—including potential projects with the Saudi Investment Recycling Co. (SIRC).

Strategic Angle

Vision 2030 is all about diversifying away from oil. This MoU not only cements UK-Saudi energy links but also advances the Kingdom’s circular economy aims—cutting landfill methane and creating green jobs. For Hydrogen Utopia, it’s a golden ticket into one of the world’s largest waste markets, which generates over 110 million tons of trash each year, and a springboard for future project awards.

Challenges and Considerations

Of course, it won’t be easy. Building waste conversion plants and refuelling stations demands hefty capital outlay, complex permitting and solid logistics for waste feedstock. On the hydrogen side, distribution and storage infrastructure have to scale up in tandem. Securing long-term waste supply contracts and navigating Saudi regulatory frameworks will be make-or-break hurdles.

Historical Context

Hydrogen Utopia has been on the London Stock Exchange’s AIM since 2021, riding the wave of EU and US net-zero targets with its waste-to-energy hydrogen solutions. Saudi Arabia, meanwhile, launched its National Hydrogen Strategy in 2020, setting an ambitious course for blue and green hydrogen exports. This MoU mirrors a global uptick in waste-to-hydrogen pilots across Europe, North America and Asia—proof that the sector is maturing fast.

Environmental and Economic Impact

If it all comes together, municipal waste in Saudi Arabia could get a serious makeover. Diverting trash from landfills slashes methane emissions and guards against soil and water pollution. Domestic hydrogen production helps decarbonize heavy-duty transport, from trucks to buses. Economically, we’re talking hundreds of construction and operations jobs—plant engineers, station technicians and more—plus a budding local supply chain for advanced materials and catalysts.

Comparative Trends

Similar collaborations are popping up around the globe. In Germany and the Netherlands, consortia are piloting waste-based hydrogen setups; in Japan, utilities are eyeing plastic-to-hydrogen pathways. What sets the Saudi initiative apart is its sheer scale potential, abundant desert solar for hybrid green/blue hydrogen production, and an integrated national refuelling network ready to serve both passenger cars and commercial fleets.

Potential Collaboration with SIRC

The MoU even leaves the door wide open for deeper cooperation with the Saudi Investment Recycling Co., the Kingdom’s main waste manager. While non-binding for now, involving SIRC could streamline waste sourcing, fast-track permits and de-risk feedstock availability—key ingredients for first-of-a-kind facilities.

Over the coming months, both sides will iron out technical scopes, lock in site selections and hammer out off-take agreements. They’ll also chase government endorsements and explore co-financing. Feasibility studies are slated for Q2 2026, with pilot plants targeted for late 2027. If all goes to plan, look for a full-scale roll-out by the early 2030s—right in time for Saudi Arabia’s hydrogen export goals.

About the Companies

Hydrogen Utopia International PLC designs waste-to-hydrogen plants using pyrolysis and gasification to drive hydrogen production and clean energy. Hydrogen Systems builds and operates hydrogen infrastructure through Shell-branded refuelling stations across Saudi Arabia, fuelling the transition to sustainable energy and industrial decarbonization.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.