Hylane and H2 MOBILITY Slash Refueling Costs to €8/kg for Heavy-Duty Trucks

January 20, 2026Ever stopped to imagine how fast Europe’s fleet of 40-tonne diesel haulers could trade their rumbling engines for whisper-quiet, zero-emission power? You might be surprised at how close that day is. On January 1, 2026, hylane, a front-runner in zero-emission technology for heavy-duty trucks, sealed the deal with H2 MOBILITY, the continent’s biggest public hydrogen-station network. Together, they’re rolling out green hydrogen at just €8 per kilogram—an eye-catching price as the EU aims to chop 55% off transport emissions by 2030 under its Fit for 55 agenda. This partnership could rewrite the rules for freight, from cost structures to carbon footprints, and finally put clean trucking in the fast lane.

Key Details of the Partnership

hylane brings to the table a growing fleet of hydrogen-powered trucks designed to cover everything from intercity lanes to regional distribution loops. H2 MOBILITY, meanwhile, runs around 40 high-capacity refuelling stations on strategic arteries—Berlin to Paris, Rotterdam to Genoa, Madrid to Lyon—and has its sights set on hitting 80 stations by 2030. By pooling their negotiating heft, they secured generous greenhouse-gas quota allocations under the EU Emissions Trading System. Those tradable certificates effectively shave operational costs, making H₂ on par with or even cheaper than diesel in total-cost-of-ownership (TCO) calculations.

Plus, a host of incentives sweetens the pot: toll exemptions, reduced parking fees, and cut-rate registration taxes for zero-emission vehicles are already on the books in many member states. And on top of that, hylane and H2 MOBILITY negotiated volume discounts on electrolyzer installations and logistics, truly fine-tuning the economics for end users. By lining up supply contracts, infrastructure roll-out, and regulatory credits, they’re creating a blueprint for scalable, cost-effective heavy-duty hydrogen transport across Europe.

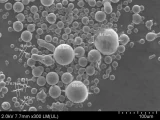

Locally Sourced Green Hydrogen via Electrolysis

At the heart of this collaboration is on-site hydrogen production via modular electrolysis units. These plug-and-play systems, now hovering around €400 per kilowatt—down from more than €800 just a few years ago—use nothing but water, renewable electricity, and a stack of advanced materials to split H₂O into hydrogen and oxygen. Each kilogram of hydrogen demands roughly 10 litres of water, drawn from municipal sources or recycled streams to minimize freshwater stress, and the entire process emits zero upstream CO₂.

The stations skip lengthy pipelines or multi-day trucks loaded with compressed gas. Instead, mobile transport trailers top them up nightly, keeping the footprint lean and flexible. A typical refill of 30–50 kg delivers around 300–500 km of range for a heavy rig, all in a refuelling time of under 15 minutes—comparable to a diesel pit stop. By localizing production next to consumption hubs, energy losses and logistical risks are drastically cut. According to research from Chalmers University of Technology, this set-up can slash lifecycle CO₂ emissions by up to 90% compared to diesel—a stark contrast to the leakage and carbon venting that dog blue or gray hydrogen routes.

Infrastructure Backed by EU Policy

It wouldn’t be happening without strong policy tailwinds. Under the Renewable Energy Directive (RED III), member states are required to substantially ramp up the share of green hydrogen in heavy transport, setting binding targets that increase year on year. Companies that use H₂ earn emissions allowances—kind of like carbon credits—that they can sell or trade on the open market, adding another revenue stream to their business model.

The Alternative Fuels Infrastructure Regulation (AFIR) has also set strict minimums: hydrogen stations must be spaced no more than 200 km apart across core TEN-T road networks, guaranteeing that long-haul operators aren’t left stranded in hydrogen deserts. And with Fit for 55 tightening CO₂ targets for new trucks, European fleet managers are under growing pressure to adapt. On top of it all, a patchwork of national grant programs, low-interest loans, and tax breaks sweetens the pot for fleet operators willing to invest in refuelling hardware and hydrogen-fuelled vehicles.

Fuel Cell Technology at Work

Underneath a hylane truck’s sleek chassis lies a proton exchange membrane (PEM) hydrogen fuel cell stack poised to deliver 50–60% electrical efficiency—double what you get out of a typical diesel engine. Inside that stack, catalysts coated with ultra-thin platinum layers spark the reaction between H₂ and O₂, generating electricity, water vapor, and enough torque to haul heavy payloads without breaking a sweat. A small lithium-ion battery buffer handles transient loads—think acceleration or hill climbs—so the fuel cell can stay in its optimal efficiency window. The result is smooth, silent power that rivals and often outperforms battery-electric alternatives when it comes to quick refuelling and payload flexibility.

With each advance in membrane durability and catalyst loading, the industry has pushed operational lifetimes past 30,000 hours—roughly three years of continuous use—before a swap is needed. R&D efforts are also targeting lower platinum-group metal content, scaling up to gigawatt-scale production lines that drive costs down by 70% compared to early prototypes. This isn’t just lab talk; these improvements are rolling out in trucks you can buy or lease today.

Historical Journey to January 2026

Getting here wasn’t a straight shot. Diesel trucks have gobbled up over one-fifth of global oil and stood as the EU’s largest transport-related CO₂ source for decades. The initial hydrogen trials in the late 2010s—often financed by small consortia—saw costs north of €15/kg and spotty station density. Many projects sputtered due to chicken-and-egg economics: no stations meant few trucks, and vice versa.

Between 2020 and 2025, things shifted. High-profile field tests like the hyFIVE hydrogen truck program and Alstom’s Coradia iLint trains demonstrated that hydrogen fuel cells could handle real-world demands. Meanwhile, geopolitical events—including the 2022 energy crunch—jolted policymakers into action. The EU committed over €7 billion to hydrogen projects under the IPCEI banner, pushing electrolyzer capacity past 5 GW and slashing capex by roughly 40%. In early 2026, a landmark paper in iScience from Chalmers University confirmed that locally produced green hydrogen offers the best lifecycle emissions profile, even accounting for colder grid mixes in Nordic winters. All of a sudden, hydrogen wasn’t just futuristic—it was feasible.

Research and Cost Targets

On the other side of the Atlantic, the U.S. Department of Energy’s Hydrogen and Fuel Cell Technologies Office codified an ambitious cost trajectory: hit $2/kg for hydrogen by the end of 2026, then drive toward $1/kg by 2031—entirely via renewable-powered electrolysis. European academics and industry players have harmonized around similar targets, pairing long-term power purchase agreements in high-wind or solar-rich regions (landing at €30–40 per MWh) with advances in alkaline, PEM, and emerging anion exchange membrane electrolyzers.

At an H₂ price of €8/kg (roughly $8.70), the math is finally working. Fuel costs per kilometre start to mirror diesel’s €1.50–1.70 per litre benchmark—even when you factor in that a litre of diesel yields around 3–4 kWh at about 40% engine efficiency. As component costs for electrolyzers and fuel cells slide, stacking value from carbon credits, grants, and grid flexibility services only sweetens a deal that was once impossible to imagine.

Positive and Negative Collateral Impacts

Positive: The immediate win is lower fuel bills, especially once you factor in the sale of unused emissions allowances. Transparent, third-party-verified CO₂ reporting tools amplify corporate ESG and TCFD disclosures, helping big logistics names sing a greener tune to investors. Analysts predict the hydrogen value chain could spawn 20,000–30,000 roles by 2030—from specialized electrolyzer manufacturing lines to regional station service teams and next-gen fuel cell maintenance crews. On-site production also hedges against the price swings of oil and gas, bolstering Europe’s energy security and smoothing out volatility for both shippers and consumers.

Negative: However, no silver bullet comes without trade-offs. Scaling electrolyzer deployments demands huge surges in renewable electricity, which could tug on grids and put upward pressure on wholesale power prices. Water consumption—albeit modest at about 10 litres per kg of H₂—could strain dry regions unless robust recycling systems are mandatory. Infrastructure roll-out remains uneven; expect Western and Northern corridors to shine while Eastern and Southern routes play catch-up for years. Market concentration risks also loom large if a handful of operators corner the station market, potentially stifling competition. Finally, early adopters run the risk of stranded investments if breakthrough battery or biofuel technologies leapfrog hydrogen on cost or convenience, especially if policy incentives shift midstream.

Beyond Europe: A Global Race

While Europe builds its hydrogen highway, other regions aren’t standing still. In China, state giants CNPC and Sinopec are laying out national hydrogen corridors, blending subsidies with new pipeline roll-outs. Japan, spurred by Tokyo’s green growth strategy, is integrating hydrogen trucks into port operations and municipal fleets, backed by generous purchase incentives. South Korea, too, is dangling rebates to get fuel-cell rigs rolling. Australia is eyeing export opportunities—producing green hydrogen for Japan and Europe—while the U.S. Inflation Reduction Act dishes out production tax credits of up to $3/kg under Section 45V, dovetailing neatly with DOE targets. As each bloc refines its own playbook, Europe’s emphasis on truly renewable hydrogen and tight CO₂ standards could set a global benchmark, ushering in a cohesive clean-hydrogen economy.

Future Competitiveness and Outlook

With on-site refuelling at €8/kg and next-gen hydrogen fuel cells delivering consistent, high-duty-cycle performance, Europe’s freight sector sits at a genuine inflection point. Fleet managers must crunch total cost of ownership—accounting for upfront capital, fuel savings, carbon credits, and maintenance schedules—but that headline price drop removes a major barrier. The road ahead hinges on three pillars: ramping up renewable capacity, scaling electrolyzer and fuel-cell manufacturing, and maintaining clear policy frameworks under RED III and AFIR. Digitalisation of station networks, advanced grid services (like demand response), and potential integration with hydrogen bunkering at ports will only deepen the ecosystem.

If the momentum holds, green hydrogen could propel Europe’s road freight to net-zero well ahead of 2050, offering a replicable template for Asia, the Americas, and beyond. And just like early adopters in telecom or IT helped shape global standards, today’s hydrogen pioneers could write the rulebook for a truly sustainable transport revolution.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.