Samsung E&A to Engineer DG Fuels’ Louisiana SAF Project

November 12, 2025You don’t need a crystal ball to see that sustainable aviation fuel is finally taking off. In a move that could reshape industrial decarbonization along the Gulf Coast, DG Fuels LLC has tapped Samsung E&A to lead the hydrogen and power systems design for its landmark SAF plant in St. James Parish, Louisiana. This hybrid hydrogen venture kicks off the Front-End Engineering Design phase before the end of 2025, setting the stage for what might become an industry benchmark.

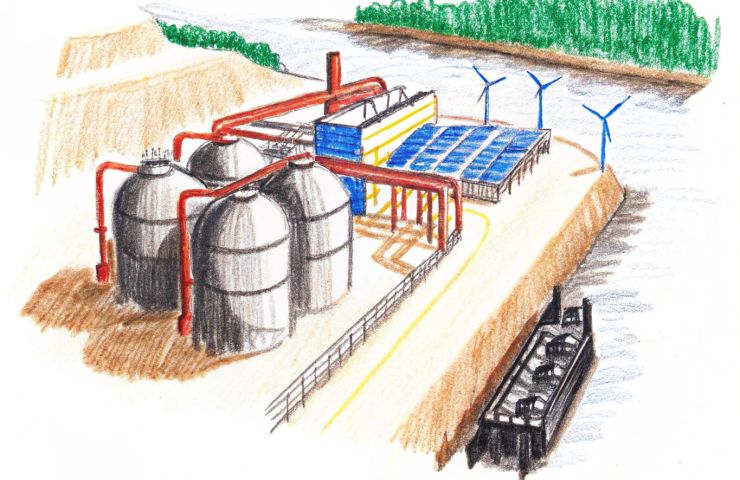

Back on November 10, 2025, DG Fuels LLC confirmed it had chosen Samsung E&A—a global EPC powerhouse—to engineer both blue hydrogen (steam methane reforming with carbon capture and storage) and green hydrogen (renewable-powered electrolyzers) systems. While the final investment decision hinges on how FEED shakes out, we’re talking roughly $8 billion in capital and up to 200 million gallons of fuel per year via Fischer-Tropsch synthesis, according to the company.

Nestled on the banks of the Mississippi in Louisiana’s industrial corridor—nicknamed “Cancer Alley”—the site is primed to leverage existing pipelines, port access and a skilled workforce. DG Fuels LLC has already locked down offtake deals for nearly 100% of its projected output, underpinned by airlines’ net-zero commitments and U.S. SAF blending credits.

Technical Deep Dive

Here’s where it gets really interesting: with a focus on sustainable energy, the plant blends proven and emerging hydrogen production methods. You’ll see blue hydrogen rolling out of steam methane reforming units paired with carbon capture and storage to sequester CO₂ underground. At the same time, green hydrogen flows from large-scale electrolyzers powered by wind and solar, delivering zero-carbon H₂ whenever renewables are dialed up.

Both streams then feed a gasification train that transforms agricultural and forestry waste into syngas (CO + H₂). That mixture heads into a Fischer-Tropsch reactor, where catalysts synthesize long-chain hydrocarbons. Downstream refining units polish the output into aviation-grade kerosene, slashing lifecycle emissions by up to 85% compared to conventional jet fuel.

Strategic Implications

Thanks to the U.S. Inflation Reduction Act’s SAF credits and hydrogen incentives, this project is more than just a refinery—it’s a sustainable energy play hinting at a $1 trillion-plus market. For Samsung E&A, landing this FEED contract cements its status in global hydrogen infrastructure. And for DG Fuels LLC, securing offtake deals years ahead derisks financing and proves airlines are all in on zero-emission tech.

Of course, it won’t be a cakewalk: sourcing feedstock at scale without ecological trade-offs, navigating permits in a community wary of industrial impacts, and sticking to the timeline are all on the to-do list. If FEED wraps by the end of 2025, stakeholders expect a final investment decision in 2026 and first fuel by 2028—a milestone that could cement Louisiana’s reputation as a clean fuels hub.

Turning History Toward a Greener Runway

Back in 2021, we only produced about 26 million gallons of sustainable aviation fuel globally. Projects like this—tying a hybrid hydrogen model to legacy chemical-industry infrastructure—are key to busting through today’s bottlenecks. By marrying old pipelines with cutting-edge electrolyzers, DG Fuels LLC and Samsung E&A are betting on adaptability: green hydrogen when renewables peak, blue hydrogen for steady baseload.

As the energy transition accelerates, all eyes will be on that FEED report. Cracking the code on costs, constructability and environmental performance will determine whether this Gulf Coast venture becomes the go-to blueprint for industrial decarbonization worldwide—or remains an ambitious design on paper.

The Catalyst

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.

With over 15 years of reporting hydrogen news, we are your premier source for the latest updates and insights in hydrogen and renewable energy.